The concept of ‘support and resistance’ holds significant prominence in the realm of trading. Interestingly, there is a diverse range of perspectives on the appropriate methods for gauging these key market indicators. Before delving into the intricacies, let’s start by exploring the fundamentals

Table of Contents

Examine the diagram depicted above. Notice how the zigzag pattern is ascending, indicating a ‘bull market’ trend

When the price ascends and subsequently retraces, the highest point before the retracement becomes a resistance level, indicating an abundance of sellers.

Conversely, when the price resumes its upward movement, the lowest point before the ascent becomes a support level, indicating a surplus of buyers.

These levels of resistance and support continually develop as the price fluctuates over time, a pattern that reverses during a downtrend.

In essence, the typical approach to trading support and resistance involves two strategies:

- Trade the ‘Bounce’

- Buy when the price approaches support.

- Sell when the price nears resistance.

- Trade the ‘Break’

- Buy when the price surpasses resistance.

- Sell when the price falls below support.

If the terms ‘bounce’ and ‘break’ seem a bit perplexing, there’s no need to worry, as we’ll delve into these concepts in greater detail later.

Plotting Support and Resistance Levels

It’s important to keep in mind that support and resistance levels aren’t precise figures.

Frequently, you may observe what seems like a breached support or resistance level, only to discover shortly afterward that the market was merely testing it.

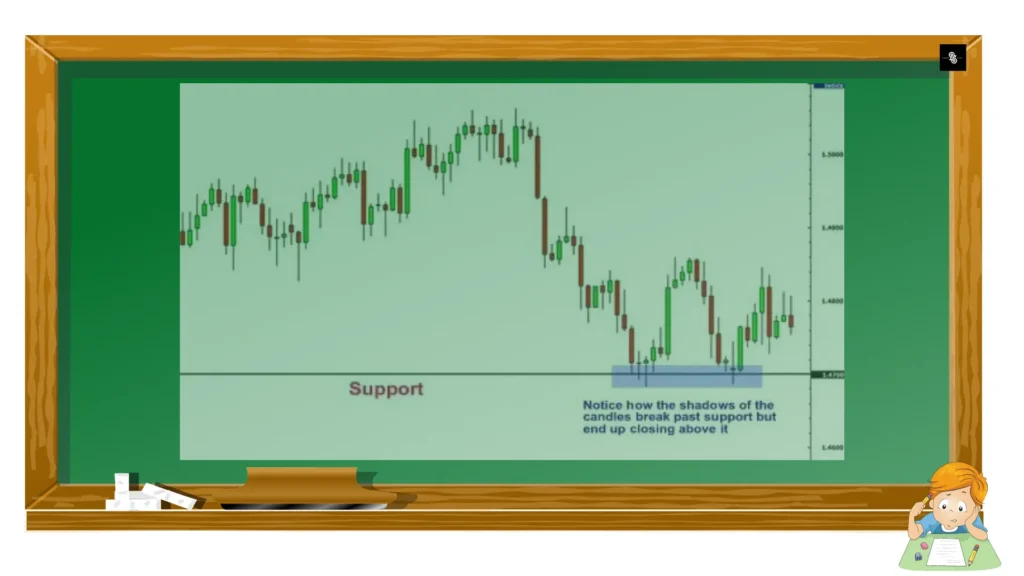

When using candlestick charts, these examinations of support and resistance are typically depicted by the shadows of the candlesticks.

Observe how the candle shadows examined the 1.4700 support level.

During those moments, it appeared as though the price was breaking the support.

Looking back, we can discern that the price was simply testing that level.

So how do we truly know if support and resistance were broken?

This question lacks a definitive answer.

Certain individuals contend that a support or resistance level is considered breached only if the price successfully closes beyond that particular level.

Nevertheless, it becomes evident that this criterion does not consistently apply.

To illustrate, let’s revisit the earlier example and examine the outcome when the price did close beyond the 1.4700 support level.

In this instance, the price initially closed beneath the 1.4700 support level but eventually rebounded above it.

If you had perceived this as a genuine breakout and sold the pair, you would have faced significant losses.

Examining the current chart, it becomes apparent that the support was not genuinely broken; it remains robust and has even strengthened.

The breach in support was merely temporary.

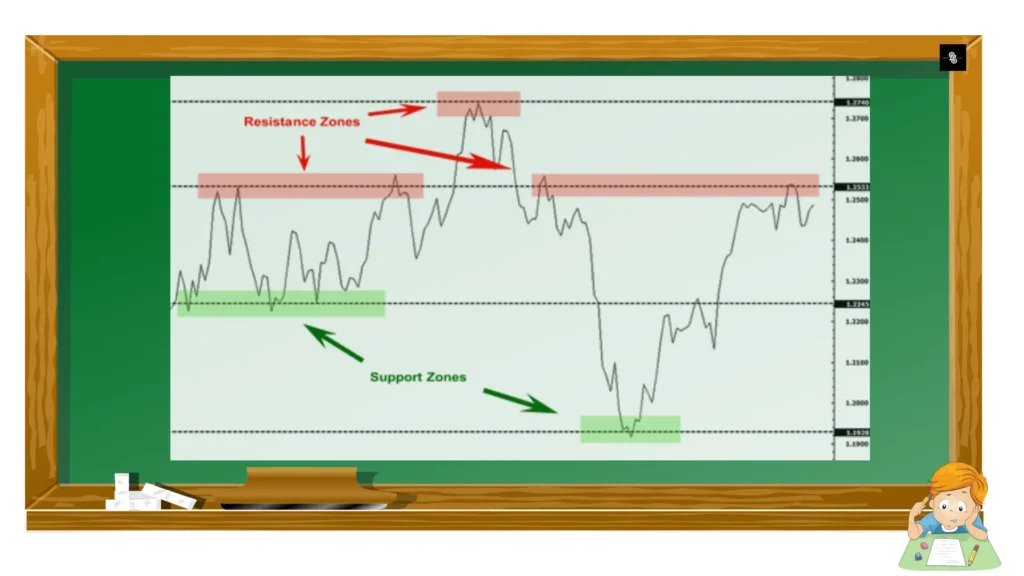

To better distinguish false breakouts, consider conceptualizing support and resistance as “zones” rather than precise figures.

To identify these zones more effectively, consider mapping support and resistance on a line chart instead of a candlestick chart.

Line charts exclusively depict the closing price, unlike candlesticks that incorporate extreme highs and lows into the visual representation.

These highs and lows can be deceptive, often reflecting mere “knee-jerk” reactions in the market.

It’s akin to someone engaging in peculiar behavior and attributing it to a reflex when questioned about it, saying, “Sorry, it’s just a reflex.”

When charting support and resistance, aim to capture deliberate market movements rather than its reflexive responses.

When examining the line chart, focus on delineating your support and resistance lines around regions where you observe the price forming multiple peaks or valleys.

Other interesting tidbits about support and resistance:

When the price surpasses resistance, that resistance may transform into potential support.

The frequency of price testing a resistance or support level without breaking it contributes to the strength of that particular area.

The potency of the subsequent move following a break in support or resistance depends on the resilience of the previously held support or resistance.

with some practice, identifying potential forex support and resistance zones will become a straightforward task.

PLEASE HELP ME

My name is Aziz Badawi, I’m 27 year old man from Palestine. Our town has recently evacuated due

to bombardments by Israel, now I am staying at a shelter with my 6 year old daughter Nadia. My wife is

dead and I’m the only one left to take care of my daughter as we are not allowed to depart to my parents house

in Nablus, she is sick with a congenital heart defect and I have no way to afford the medicine she needs anymore.

People here at the shelter are much in the same conditions as ourselves…

I’m looking for a kind soul who can help us with a donation, any amount will help even 1$ we will

save money to get her medicine, the doctor at the shelter said if I can’t find a way to get her the

medication she needs her little heart may give out during the coming weeks.

If you wish to help me and my daughter please make any amount donation in bitcoin cryptocurrency

to this bitcoin wallet: bc1qcfh092j2alhswg8jr7fr7ky2sd7qr465zdsrh8

If you cannot donate please forward this message to your friends, thank you to everyone who’s helping me and my daughter.