Table of Contents

Can I do trade in currencies?

In quite simple words if you want to know what forex allows you to trade currencies in global financial market.

We first make our habits, and then our habits make us. John Dryden

And to make profit i will give a simplle formula and that is like suppose when you think one currency is stronger then the other and you end up thinking that correct then you can make profit.

Once upon a time you think of going on international trip, now that you have travelled to another country, you will find a currency booth exchange at the airpot, and then you will change your current currency into the currency of the country you are visting now.

There you notice a screen which display different rate exchnages for different currencies.

An exchange rate represents the comparative value between two currencies originating from distinct countries.

Discovering the value of the “Japanese yen,” you might exclaim, “Impressive! My one dollar is equivalent to 100 yen? With ten dollars, I could become wealthy!”

In such a scenario, you’ve effectively engaged in the forex market by swapping one currency for another.

In forex trading language, if you’re an American visiting Japan, this means you’ve sold dollars to bought yen.

As you prepare to return home, you visit the currency exchange booth to convert the remaining yen (Tokyo can be costly!), and you observe that the exchange rates have shifted.

It is these fluctuations in exchange rates that create opportunities for profit in the foreign exchange market.

what is forex?

The largest financial market globally, commonly referred to as “forex” or “FX,” is the foreign exchange market.

The foreign exchange (FX) market is a worldwide, decentralized platform where global currencies are traded. With exchange rates shifting by the second, the market is in a constant state of flux.

A minuscule proportion of currency transactions occurs within the “real economy,” involving international trade and tourism, akin to the airport scenario mentioned earlier.

Rather than being driven by practical purposes, the majority of currency transactions within the global foreign exchange market are executed for speculative motives, involving both buying and selling.

Individuals involved in currency trading, often referred to as currency speculators, purchase currencies with the expectation of selling them at a higher price in the future.

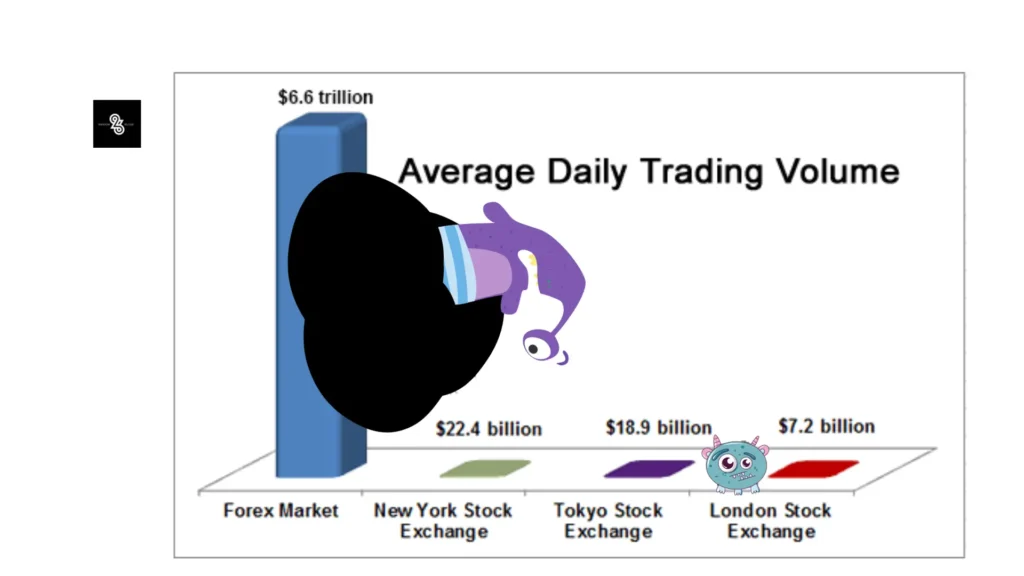

In contrast to the relatively modest daily volume of $200 billion on the New York Stock Exchange (NYSE), the foreign exchange market appears incredibly vast, boasting a colossal daily trade volume of $6.6 TRILLION – yes, trillion with a “t.”

Let’s pause and illustrate this with a 3 leged monster metaphor…

The New York Stock Exchange (NYSE), the biggest stock market globally, handles a daily volume of approximately $200 billion. If we were to symbolize the NYSE with a monster, it would be comparable to the following…

Appears “scary”. Appears effective. Some might even perceive it as attractive.

You come across updates about the NYSE daily, whether it’s on CNBC, Bloomberg, BBC, or even at your local gym.

People often refer to the stock market when they mention the “market,” and the NYSE stands out—it’s large, vocal, and loves to attract attention with phrases like “The NYSE is up today, blah, blah.”

However, when you contrast it with the forex market, the comparison would be something like this…

Oh, the NYSE seems tiny in comparison to the forex market! It’s almost like it doesn’t stand a chance!

Makes you question if the “S” in NYSE stands for “Stock” or “Scrawny”? 🤣

The cryptocurrency market is even smaller.

Take a look at the graph depicting the average daily trading volume for the forex market, New York Stock Exchange, Tokyo Stock Exchange, and London Stock Exchange:

The currency market is more than 200 times LARGER! It’s absolutely ENORMOUS!

But wait, there’s a twist!

That massive $6.6 trillion figure accounts for the entire global foreign exchange market. However, the “spot” market, the part most relevant to forex traders, is smaller at $2 trillion per day.

And if you’re only considering the daily trading volume from retail traders (that’s us), it’s even more modest. Pinpointing the precise size of the retail segment in the FX market is challenging, but it’s estimated to be roughly 3-5% of the overall daily FX trading volumes, amounting to around $200-300 billion (likely less).

So, while the forex market is undeniably substantial, it’s not as colossal as some would want you to think.

Don’t buy into the hype of “forex is a $6.6 trillion market”! The massive number may sound impressive but can be a tad misleading. We prefer to keep it honest and real.

Beyond its vast size, the market seldom shuts its doors! It operates nearly around the clock.

The forex market stays active 24 hours a day and 5 days a week, only taking a breather during the weekend. (Quite the slackers!)

In contrast to stock or bond markets, the forex market doesn’t close at the conclusion of each business day. Instead, trading transitions to different financial centers across the globe.

The trading day kicks off as traders in Auckland/Wellington wake up, then progresses through Sydney, Singapore, Hong Kong, Tokyo, Frankfurt, London, and ultimately, New York, before resetting for a new round in New Zealand!

3 thoughts on “What is forex trading?”