Table of Contents

In the fast-paced world of forex trading, understanding candlestick patterns can be the key to unlocking profitable opportunities. These visual representations of price movements provide valuable insights into market sentiment and potential future price movements. Among the myriad of candlestick patterns, some of the most essential for beginners to grasp are the Hammer, Bearish Engulfing, Hanging Man, Gravestone Doji. Let’s delve into each of these patterns and uncover what they signify in forex trading.

1. Hammer

The Hammer is a bullish reversal pattern that often appears at the bottom of a downtrend. It is characterized by a small body and a long lower shadow, resembling a hammer. This pattern indicates that despite downward pressure, buyers managed to push the price back up, signaling a potential reversal in sentiment. When spotted after a downtrend, the Hammer suggests that buyers are gaining strength, and a bullish reversal may be imminent.

2. Bearish Engulfing

On the flip side, the Bearish Engulfing pattern is a bearish reversal signal that occurs at the top of an uptrend. It consists of a large bearish candlestick that engulfs the preceding smaller bullish candlestick. This pattern reflects a shift in momentum from bullish to bearish, as sellers overpower buyers, leading to a potential trend reversal. Traders often look for confirmation through subsequent price action to validate the signal.

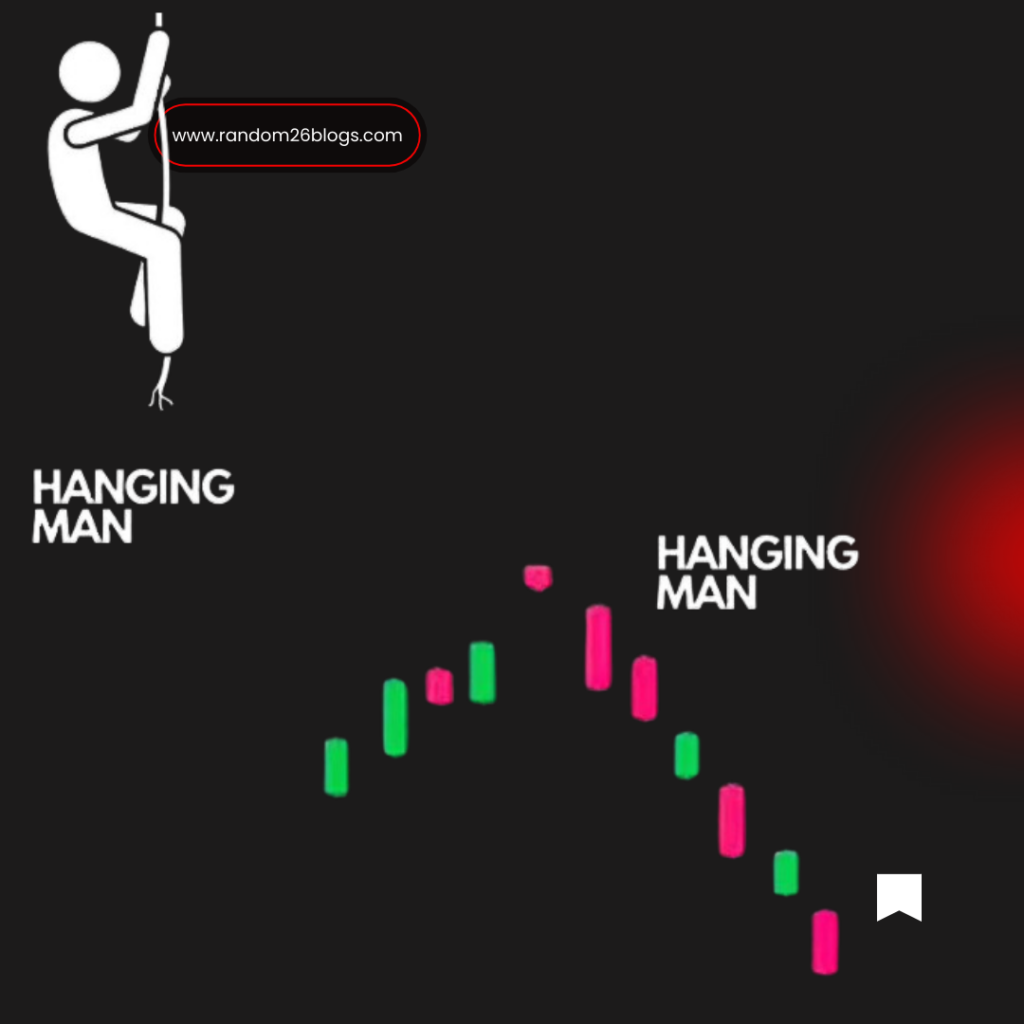

3. Hanging Man

The Hanging Man is another bearish reversal pattern that appears at the top of an uptrend. It resembles a candlestick with a small body and a long lower shadow, resembling a hanging man. This pattern suggests that despite an attempt by buyers to push the price higher, sellers stepped in, leading to a potential reversal in trend. Similar to the Bearish Engulfing, traders typically seek confirmation to validate the Hanging Man signal.

4. Gravestone Doji

The Gravestone Doji is a bearish reversal pattern characterized by a candlestick with a small body and a long upper shadow, resembling a gravestone. It occurs at the top of an uptrend and indicates that despite an initial push higher, sellers regained control, resulting in a potential reversal in price direction. Like other reversal patterns, traders often wait for confirmation before acting on the Gravestone Doji signal.

Understanding candlestick patterns is essential for navigating the complexities of forex trading. By recognizing patterns like the Hammer, Bearish Engulfing, Hanging Man, and Gravestone Doji, beginners can gain valuable insights into market sentiment and potential trend reversals. However, it’s crucial to remember that no single pattern guarantees success, and traders should always incorporate other technical and fundamental analysis tools to make well-informed trading decisions. With practice and experience, mastering candlestick patterns can become a powerful asset in a trader’s toolkit.

I really appreciate your work

Tìm hiểu những quà tặng tuyệt vời tại yo88.com, được thiết kế đặc biệt để nâng cao trải nghiệm chơi game của bạn.

Khám phá nền tảng yo88.com liền mạch, được thiết kế để tăng cường trải nghiệm giải trí của bạn.

yo88.com đảm bảo dịch vụ khách hàng tốt nhất, nâng tầm các nỗ lực cá cược của bạn lên một tầm cao mới.

Khám phá những quà tặng độc đáo tại https://yo88.com/, được thiết kế để tối đa hóa hành trình chơi game của bạn.

Khám phá những ưu đãi hấp dẫn tại yo88.com, được thiết kế đặc biệt để tối ưu hóa trải nghiệm cá cược của bạn.

Khám phá nền tảng yo88.com dễ sử dụng, được thiết kế để tăng cường trải nghiệm giải trí của bạn.