Table of Contents

In the fast-paced world of forex trading, understanding Fair Value Gaps (FVGs) is like deciphering clues in a treasure hunt. However, many traders stumble over common mistakes, causing them to miss the mark. Let’s embark on a journey to unravel these missteps and pave the way for smoother sailing in the forex seas.

Mistake 1: Assuming Every Fair Value Gap Will Hold

Picture this: you’re eyeing a potential trade, and you spot what seems like the perfect Fair Value Gap (FVG). Excitedly, you place your bet, only to watch in dismay as the market moves against you. What went wrong?

Here’s the deal: not all FVGs are created equal. To stack the odds in your favor, you need to consider three critical factors:

- Context: Think of context as the backstory behind each FVG. Are you looking at it through the lens of a Higher Time Frame (HTF)? The general rule of thumb is this: the higher the timeframe, the stronger the FVG. So, keep your eyes peeled for those originating from the HTF.

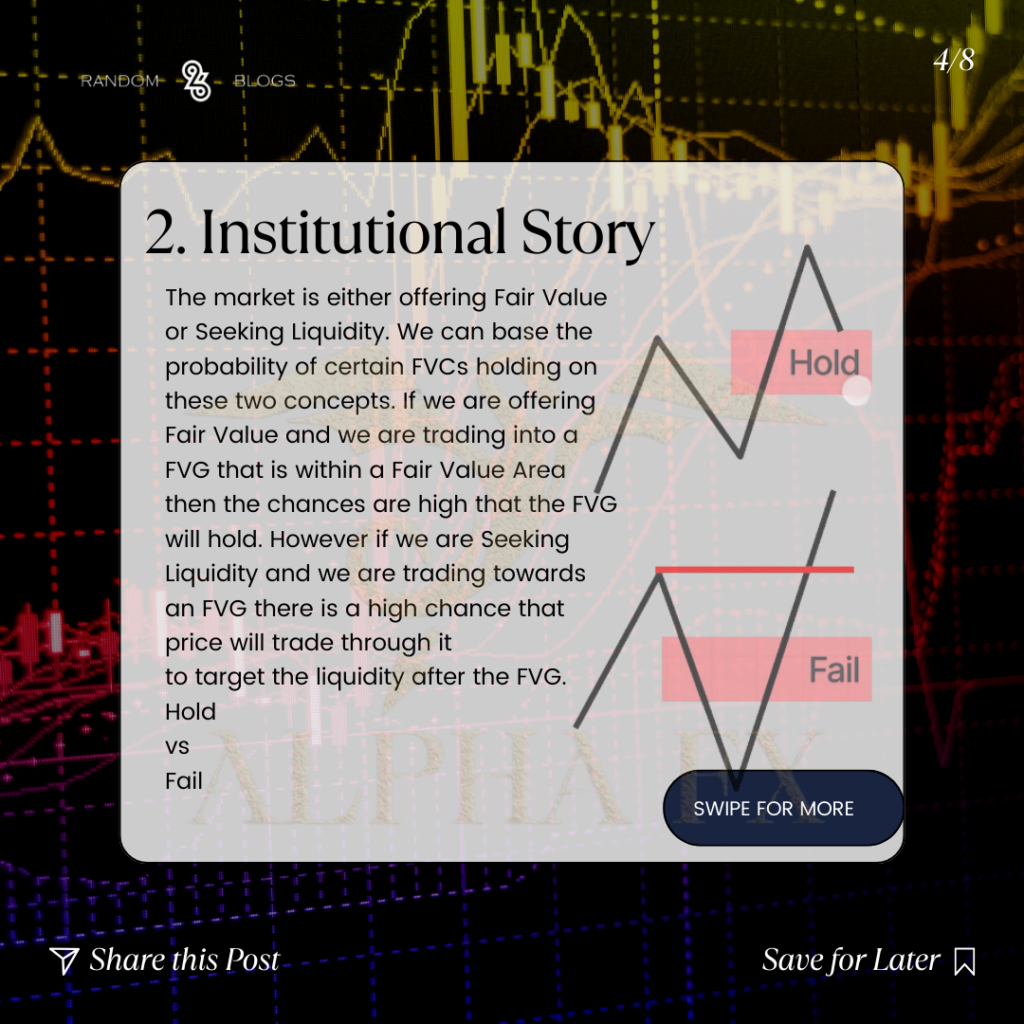

- Institutional Story: Imagine the market as a storyteller, weaving tales of Fair Value and liquidity. When the market offers Fair Value, FVGs within a Fair Value Area are likely to hold. However, if it’s seeking liquidity, tread cautiously, as FVGs might crumble under pressure.

- Seek and Destroy Conditions: Ever felt like you’re wandering aimlessly in a market maze? That’s what happens during Seek and Destroy Conditions. When the market is range-bound or consolidating, FVGs lose their grip, leading to low probability trades. Avoid these conditions like the plague.

Mistake 2: Assuming You Need to Use Old Fair Value Gaps

Now, let’s talk about relics from the past. Trading outdated FVGs is akin to trying to solve today’s puzzle with yesterday’s clues. It just doesn’t work. Focus your attention on recent FVGs—they hold the key to accuracy and success.

Mistake 3: Assuming Fair Value Gaps Always Point in the Correct Direction

FVGs are like signposts in the forex wilderness—they guide you, but they’re not infallible. Don’t fall into the trap of thinking they always point in the right direction. Sometimes, they’re just smoke and mirrors, leading you astray. Stay vigilant, especially around Liquidity Sweeps, where FVGs can take a sharp turn and catch you off guard.

FVGs are like signposts in the forex wilderness—they guide you, but they’re not infallible. Don’t fall into the trap of thinking they always point in the right direction. Sometimes, they’re just smoke and mirrors, leading you astray. Stay vigilant, especially around Liquidity Sweeps, where FVGs can take a sharp turn and catch you off guard.

What Should You Do?

Now that we’ve uncovered the pitfalls, let’s chart a course to smoother waters:

Firstly, arm yourself with knowledge. Educate yourself about FVGs, market dynamics, and trading strategies. The more you know, the better equipped you’ll be to navigate the forex terrain.

Secondly, practice patience. Rome wasn’t built in a day, and neither is forex mastery. Take the time to hone your skills, analyze the market, and refine your trading approach.

Lastly, embrace adaptability. The forex landscape is ever-evolving, so be prepared to pivot when necessary. Stay flexible, adjust your strategies as needed, and never stop learning.

In conclusion, mastering Fair Value Gaps requires a blend of art and science. By avoiding common mistakes, staying informed, and adapting to changing market conditions, you can increase your chances of success in the forex arena. So, gear up, stay vigilant, and may the winds of fortune be ever in your favor. Happy trading!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.