The United Arab Emirates (UAE) continues to stand tall as one of the world’s most lucrative property investment destinations. With Dubai and Abu Dhabi emerging as the country’s two real estate powerhouses, investors often face the same critical question — which market offers better ROI (Return on Investment)?

As of 2024–2025, both cities are showing impressive resilience and steady growth, yet their investment dynamics differ significantly. Here’s an in-depth look at how Dubai and Abu Dhabi’s real estate markets compare — and where smart investors should focus next.

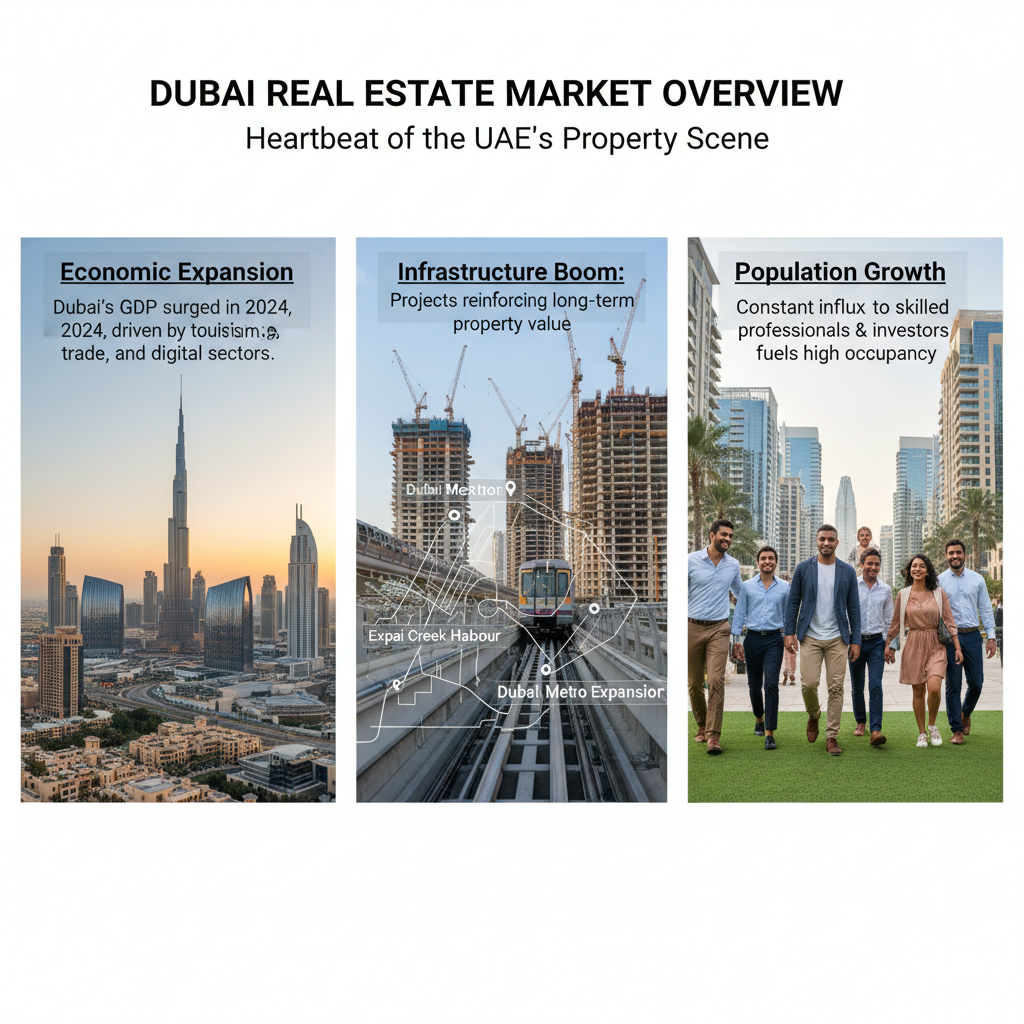

Dubai Real Estate Market Overview

Dubai remains the heartbeat of the UAE’s property scene, driven by global business appeal, world-class infrastructure, and a cosmopolitan lifestyle that continues to attract expats and entrepreneurs alike.

Key Growth Drivers

- Economic Expansion: Dubai’s GDP surged in 2024, reflecting strong performance in tourism, trade, and digital sectors — all contributing to higher real estate confidence.

- Infrastructure Boom: Projects like the Dubai Metro expansion, Dubai Creek Harbour, and Expo City developments are reinforcing the city’s long-term property value.

- Population Growth: With a constant influx of skilled professionals and investors, Dubai maintains high occupancy and rental demand in both residential and commercial segments.

ROI Snapshot

The average ROI in Dubai currently ranges between 6% and 8% for residential properties, among the highest globally. Popular investor zones include Downtown Dubai, Business Bay, Jumeirah Village Circle (JVC), and Dubai Marina, offering excellent rental yields and resale potential.

Abu Dhabi Real Estate Market Overview

Abu Dhabi, the UAE’s capital, offers a more stable and regulated property environment — a preferred choice for investors prioritizing security, sustainability, and steady appreciation.

Key Growth Drivers

- Economic Stability: Backed by robust oil revenues and rapid diversification into non-oil sectors like finance, healthcare, and technology.

- Sustainable Urban Planning: Developments like Masdar City and Saadiyat Island emphasize eco-friendly, smart living — attracting global attention.

- Family-Friendly Lifestyle: The city’s serene environment, quality infrastructure, and long-term residency programs make it ideal for end-users and families.

ROI Snapshot

Abu Dhabi’s average ROI typically ranges between 5% and 7%, with consistent capital growth. Top-performing areas include Al Reem Island, Yas Island, and Saadiyat Island, known for premium developments and sustainable communities.

Key Trends Shaping UAE Real Estate

- Sustainability Takes the Lead

Both Dubai and Abu Dhabi are investing heavily in green developments and smart city projects — aligning with global ESG standards and investor preferences. - Technology Integration (PropTech)

Virtual property tours, AI-based valuation tools, and blockchain-powered transactions are making the market more transparent and efficient. - Regulatory Reforms

Long-term visas, foreign ownership flexibility, and digital land registries have made property investment in the UAE easier than ever for global investors. - High-Growth Areas to Watch

- Dubai: Expo City, Dubai South, and Mohammed Bin Rashid City

- Abu Dhabi: Saadiyat Island, Al Reem Island, and Al Raha Beach

Challenges Investors Should Consider

While both markets are thriving, it’s essential to balance potential gains against possible risks:

- Dubai: Market fluctuations can be sharp due to high transaction volumes and speculative buying.

- Abu Dhabi: Slower short-term returns but greater long-term stability.

- Financing & Legal Hurdles: Investors should stay updated on mortgage rules, ownership zones, and transaction procedures.

Pro Tip: Work with RICS-certified valuation and advisory firms like Reliant Surveyors, who provide data-driven insights, accurate valuations, and regulatory guidance to protect your investments.

Technology and Innovation Transforming UAE Real Estate

The UAE’s real estate sector is rapidly evolving with PropTech, IoT-based smart buildings, and blockchain-enabled transactions enhancing efficiency, security, and customer experience.

From automated valuation models (AVMs) to virtual reality tours, these innovations are improving transparency, boosting investor confidence, and streamlining property transactions.

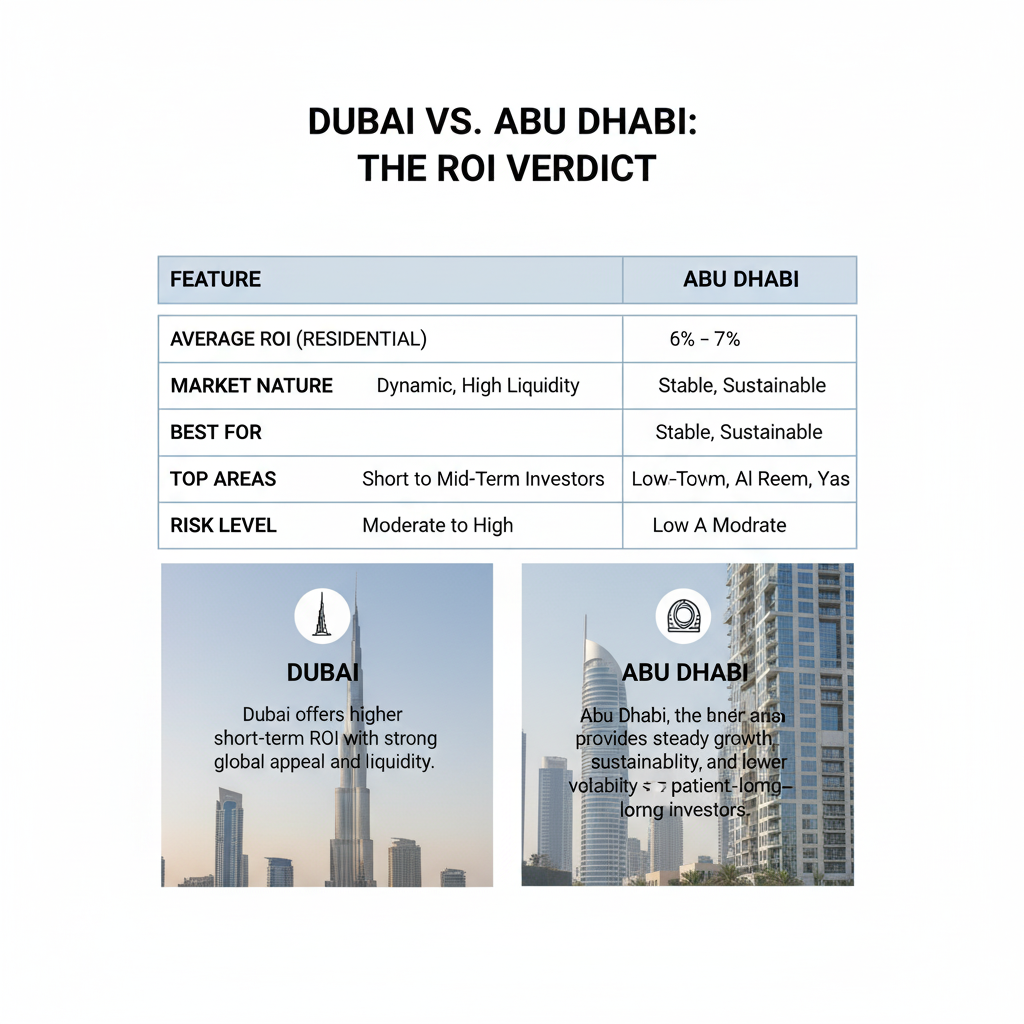

Dubai vs. Abu Dhabi: The ROI Verdict

| Feature | Dubai | Abu Dhabi |

|---|---|---|

| Average ROI (Residential) | 6% – 8% | 5% – 7% |

| Market Nature | Dynamic, High Liquidity | Stable, Sustainable |

| Best For | Short to Mid-Term Investors | Long-Term, End-Users |

| Top Areas | Downtown, JVC, Marina | Saadiyat, Al Reem, Yas |

| Risk Level | Moderate to High | Low to Moderate |

Dubai offers higher short-term ROI with strong global appeal and liquidity.

Abu Dhabi, on the other hand, provides steady growth, sustainability, and lower volatility — ideal for patient, long-term investors.

Reliant Surveyors: Your Trusted Real Estate Partner

Since 1977, Reliant Surveyors has been a cornerstone in UAE real estate, offering:

- Property Valuations & Asset Appraisals

- Strategic Investment Consultancy

- Project Management & Advisory Services

Our RICS-certified experts deliver trusted insights that help investors maximize returns and mitigate risks.

High-yield opportunities

Whether you choose Dubai’s dynamic, high-yield opportunities or Abu Dhabi’s stable, sustainable ecosystem, both cities stand at the forefront of real estate innovation.

With continued government reforms, smart city initiatives, and global investor confidence, the UAE real estate market in 2025–2026 remains one of the strongest investment destinations worldwide.

Read More Insights:

Explore expert analysis and market reports at Random26Blogs

Dubai real estate market 2025, Abu Dhabi property investment, UAE real estate ROI, Dubai vs Abu Dhabi comparison, best ROI UAE, property investment in UAE, Dubai property market forecast, Abu Dhabi housing trends, Reliant Surveyors UAE, Vision 2030 real estate UAE.