Saving money isn’t just about luck—it’s about developing smart habits that anyone can adopt. If you’re looking to boost your savings game, take a page from women who have mastered the art of saving. Here are eight habits they swear by:

1. Setting Clear Financial Goals

Successful savers know where they’re headed. They set specific financial goals like building an emergency fund, saving for a dream vacation, or even planning for retirement. Having these targets in mind helps them stay focused and motivated to save consistently.

2. Budgeting Like a Pro

Budgeting isn’t about restricting yourself; it’s about being intentional with your money. These savvy savers create budgets that outline their income, expenses, and savings goals. It’s all about knowing where every dollar goes and making adjustments when needed.

3. Putting Saving First

Ever heard of paying yourself first? It’s a golden rule for these money-savvy women. By prioritizing savings right off the bat—whether it’s through automatic transfers or setting aside a portion of each paycheck—they ensure their savings grow steadily.

4. Embracing Smart Spending

Being frugal is their superpower. They’re not about being cheap but making wise spending decisions. It’s about finding value in purchases, using coupons, and knowing when to splurge and when to save.

5. Automating Savings

Making saving effortless is key. They set up automatic transfers from their checking to savings accounts. It’s a set-it-and-forget-it approach that removes the temptation to spend money earmarked for their goals.

6. Tackling Debt Wisely

Managing debt is a priority. They focus on paying off high-interest debts first and avoid taking on new debt whenever possible. It’s all about freeing up more money for saving and investing in their future.

7. Investing in Financial Education

Knowledge is power. They educate themselves about personal finance through books, podcasts, or workshops. Understanding topics like investing, budgeting, and retirement planning empowers them to make informed financial decisions.

8. Planning Ahead

They’re not just thinking about today—they’re planning for tomorrow. These savvy savers have a long-term perspective. They save for retirement, prepare for unexpected expenses, and invest wisely to secure their financial future.

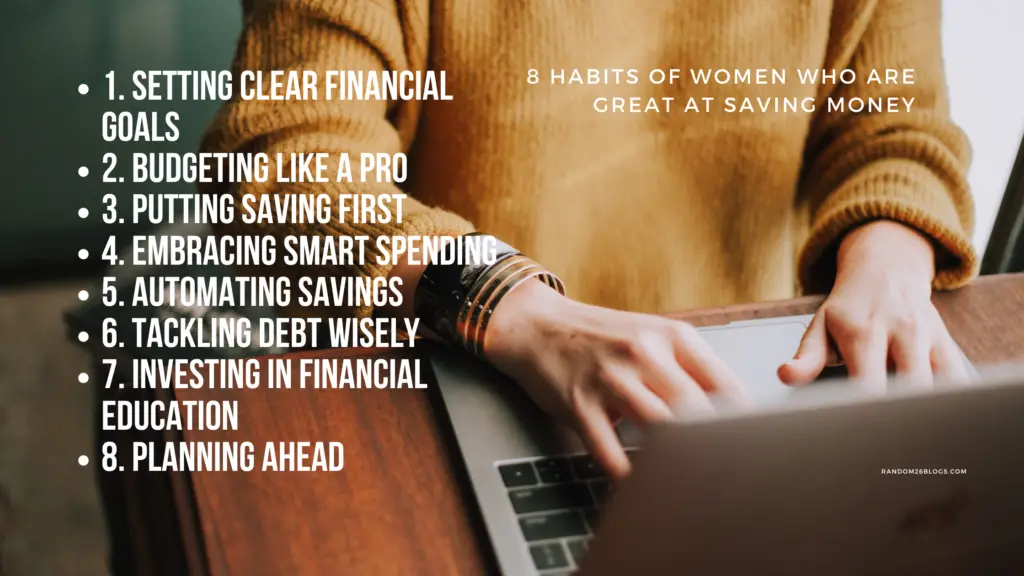

8 Habits of Women Who Are Great at Saving Money

Becoming great at saving money isn’t rocket science—it’s about adopting smart habits and sticking with them. By setting clear goals, budgeting wisely, embracing frugality, and automating savings, you too can build a strong financial foundation. Remember, consistency and patience are key on the road to financial freedom.

1 thought on “8 Habits of Women Who Are Great at Saving Money”